|

CHAPTER 15 AGGREGATE DEMAND AND AGGREGATE SUPPLY BRIEF PRINCIPLES OF MACROECONOMICS |

|

CHAPTER 15 AGGREGATE DEMAND AND AGGREGATE SUPPLY BRIEF PRINCIPLES OF MACROECONOMICS |

LEARNING OBJECTIVES:

By the end of this chapter, you should understand:

Ø three key facts about short-run economic fluctuations.

Ø how the economy in the short run differs from the economy in the long run.

Ø how to use the model of aggregate demand and aggregate supply to explain economic fluctuations.

Ø how shifts in either aggregate demand or aggregate supply can cause booms and recessions.

KEY POINTS:

1. All societies experience short-run economic fluctuations around long-run trends. These fluctuations are irregular and largely unpredictable. When recessions do occur, real GDP and other measures of income, spending, and production fall, and unemployment rises.

2. Classical economic theory is based on the assumption that nominal variables such as the money supply and the price level do not influence real variables such as output and employment. Most economists believe that this assumption is accurate in the long run but not in the short run. Economists analyze short-run economic fluctuations using the model of aggregate demand and aggregate supply. According to this model, the output of goods and services and the overall level of prices adjust to balance aggregate demand and aggregate supply.

3. The aggregate-demand curve slopes downward for three reasons. The first is the wealth effect: A lower price level raises the real value of households’ money holdings, which stimulates consumer spending. The second is the interest-rate effect: A lower price level reduces the quantity of money households demand; as households try to convert money into interest-bearing assets, interest rates fall, which stimulates investment spending. The third is the exchange-rate effect: As a lower price level reduces interest rates, the dollar depreciates in the market for foreign-currency exchange, which stimulates net exports.

4. Any event or policy that raises consumption, investment, government purchases, or net exports at a given price level increases aggregate demand. Any event or policy that reduces consumption, investment, government purchases, or net exports at a given price level decreases aggregate demand.

5. The long-run aggregate-supply curve is vertical. In the long run, the quantity of goods and services supplied depends on the economy’s labor, capital, natural resources, and technology, but not on the overall level of prices.

6. Three theories have been proposed to explain the upward slope of the short-run aggregate-supply curve. According to the sticky-wage theory, an unexpected fall in the price level temporarily raises real wages, which induces firms to reduce employment and production. According to the sticky-price theory, an unexpected fall in the price level leaves some firms with prices that are temporarily too high, which reduces their sales and causes them to cut back production. According to the misperceptions theory, an unexpected fall in the price level leads suppliers to mistakenly believe that their relative prices have fallen, which induces them to reduce production. All three theories imply that output deviates from its natural rate when the actual price level deviates from the price level that people expected.

7. Events that alter the economy’s ability to produce output, such as changes in labor, capital, natural resources, or technology, shift the short-run aggregate-supply curve (and may shift the long-run aggregate-supply curve as well). In addition, the position of the short-run aggregate-supply curve depends on the expected price level.

8. One possible cause of economic fluctuations is a shift in aggregate demand. When the aggregate-demand curve shifts to the left, output and prices fall in the short run. Over time, as a change in the expected price level causes perceptions, wages, and prices to adjust, the short-run aggregate-supply curve shifts to the right, and the economy returns to its natural rate of output at a new, lower price level.

9. A second possible cause of economic fluctuations is a shift in aggregate supply. When the aggregate-supply curve shifts to the left, the short-run effect is falling output and rising prices―a combination called stagflation. Over time, as perceptions, wages, and prices adjust, the price level falls back to its original level, and output recovers.

I. Economic activity fluctuates from year to year.

A. Definition of recession: a period of declining real incomes and rising unemployment.

B. Definition of depression: a severe recession.

II. Three Key Facts about Economic Fluctuations

A. Fact 1: Economic Fluctuations Are Irregular and Unpredictable

1. Fluctuations in the economy are often called the business cycle.

2. Economic fluctuations correspond to changes in business conditions.

3. These fluctuations are not at all regular and are almost impossible to predict.

4. Panel (a) of Figure 1 shows real GDP since 1965. The shaded areas represent recessions.

B. Fact 2: Most Macroeconomic Quantities Fluctuate Together

1. Real GDP is the variable that is most often used to examine short-run changes in the economy.

2. However, most macroeconomic variables that measure some type of income, spending, or production fluctuate closely together.

3. Panel (b) of Figure 1 shows how investment spending changes over the business cycle. Note that investment spending falls during recessions just as real GDP does.

C. Fact 3: As Output Falls, Unemployment Rises

1. Changes in the economy’s output level will have an effect on the economy’s utilization of its labor force.

2. When firms choose to produce a smaller amount of goods and services, they lay off workers, which increases the unemployment rate.

3. Panel (c) of Figure 1 shows how the unemployment rate changes over the business cycle. Note that during recessions, unemployment generally rises. Note also that the unemployment rate never approaches zero but instead fluctuates around its natural rate of about 5% or 6%.

D. In The News: Offbeat Indicators

1. When the economy goes into a recession, many economic variables are affected.

2. This is an article from USA Today discussing how the volume of trash generated by consumers is related to the health of the economy.

III. Explaining Short-Run Economic Fluctuations

A. The Assumptions of Classical Economics

1. The classical dichotomy is the separation of variables into real variables and nominal variables.

2. According to classical theory, changes in the money supply only affect nominal variables.

B. The Reality of Short-Run Fluctuations

1. Most economists believe that the classical theory describes the world in the long run but not in the short run.

2. Beyond a period of several years, changes in the money supply affect prices and other nominal variables, but do not affect real GDP, unemployment, or other real variables.

3. However, when studying year-to-year fluctuations in the economy, the assumption of monetary neutrality is not appropriate. In the short run, most real and nominal variables are intertwined.

C. The Model of Aggregate Demand and Aggregate Supply

![]() Review

demand, supply, and equilibrium. Microeconomic variables of price and quantity

can be aggregated into a price level (either the GDP deflator or the Consumer

Price Index) and total output (real GDP).

Review

demand, supply, and equilibrium. Microeconomic variables of price and quantity

can be aggregated into a price level (either the GDP deflator or the Consumer

Price Index) and total output (real GDP).

1. Definition of model of aggregate demand and aggregate supply: the model that most economists use to explain short-run fluctuations in economic activity around its long-run trend.

2. We can show this model using a graph.

a. The variable on the vertical axis is the average level of prices in the economy, as measured by the CPI or the GDP deflator.

b. The variable on the horizontal axis is the economy’s output of goods and services, as measured by real GDP.

c. Definition of aggregate-demand curve: a curve that shows the quantity of goods and services that households, firms, and the government want to buy at each price level.

d. Definition of aggregate-supply curve: a curve that shows the quantity of goods and services that firms choose to produce and sell at each price level.

3. In this model, the price level and the quantity of output adjust to bring aggregate demand and aggregate supply into balance.

IV. The Aggregate-Demand Curve

A. Why the Aggregate-Demand Curve Slopes Downward

1. Recall that GDP (Y ) is made up of four components: consumption (C ), investment (I ), government purchases (G ), and net exports (NX ).

![]()

2. Each of the four components is a part of aggregate demand.

a. Government purchases are assumed to be fixed by policy.

b. This means that to understand why the aggregate-demand curve slopes downward, we must understand how changes in the price level affect consumption, investment, and net exports.

![]() Remember

the difference between changes in quantity demanded (movements along the demand

curve) and changes in demand (shifts in the demand curve). All three of

these effects begin with a decrease (or increase) in the price level and end

with an increase (decrease) in aggregate quantity demanded.

Remember

the difference between changes in quantity demanded (movements along the demand

curve) and changes in demand (shifts in the demand curve). All three of

these effects begin with a decrease (or increase) in the price level and end

with an increase (decrease) in aggregate quantity demanded.

3. The Price Level and Consumption: The Wealth Effect

a. A decrease in the price level raises the real value of money and makes consumers feel wealthier, which in turn encourages them to spend more.

b. The increase in consumer spending means a larger quantity of goods and services demanded.

4. The Price Level and Investment: The Interest-Rate Effect

a. The lower the price level, the less money households need to buy goods and services.

b. When the price level falls, households try to reduce their holdings of money by lending some out (either in financial markets or through financial intermediaries).

c. As households try to convert some of their money into interest-bearing assets, the interest rate will drop.

d. Lower interest rates encourage borrowing firms to borrow more to invest in new plants and equipment and it encourages households to borrow more to invest in new housing.

e. Thus, a lower price level reduces the interest rate, encourages greater spending on investment goods, and therefore increases the quantity of goods and services demanded.

5. The Price Level and Net Exports: The Exchange-Rate Effect

a. A lower price level in the United States lowers the U.S. interest rate.

b. American investors will seek higher returns by investing abroad, increasing U.S. net capital outflow.

c. The increase in net capital outflow raises the supply of dollars, lowering the real exchange rate.

d. U.S. goods become relatively cheaper to foreign goods. Exports rise, imports fall, and net exports increase.

e. Therefore, when a fall in the U.S. price level causes U.S. interest rates to fall, the real exchange rate depreciates, and U.S. net exports rise, thereby increasing the quantity of goods and services demanded.

6. All three of these effects imply that, all else being equal, there is an inverse relationship between the price level and the quantity of goods and services demanded.

![]() The

aggregate-demand curveis drawn assuming that all else is held constant. Factors

that might shift the aggregate demand curve are related to changes in

consumption, investment, government purchases, and net exports. If any of these

four components of GDP change (for reasons other than a change in the price

level), the aggregate-demand curve will shift.

The

aggregate-demand curveis drawn assuming that all else is held constant. Factors

that might shift the aggregate demand curve are related to changes in

consumption, investment, government purchases, and net exports. If any of these

four components of GDP change (for reasons other than a change in the price

level), the aggregate-demand curve will shift.

B. Why the Aggregate-Demand Curve Might Shift

1. Shifts Arising from Changes in Consumption

a. If Americans become more concerned with saving for retirement and reduce current consumption, aggregate demand will decline.

b. If the government cuts taxes, it encourages people to spend more, resulting in an increase in aggregate demand.

2. Shifts Arising from Changes in Investment

a. Suppose that the computer industry introduces a faster line of computers and many firms decide to invest in new computer systems. This will lead to an increase in aggregate demand.

b. If firms become pessimistic about future business conditions, they may cut back on investment spending, shifting aggregate demand to the left.

c. An investment tax credit increases the quantity of investment goods that firms demand, which results in an increase in aggregate demand.

d. An increase in the supply of money lowers the interest rate in the short run. This leads to more investment spending, which causes an increase in aggregate demand.

3. Shifts Arising from Changes in Government Purchases

a. If Congress decides to reduce purchases of new weapon systems, aggregate demand will fall.

b. If state governments decide to build more highways, aggregate demand will shift to the right.

4. Shifts Arising from Changes in Net Exports

a. When Europe experiences a recession, it buys fewer American goods, which lowers net exports at every price level. Aggregate demand will shift to the left.

b. If the exchange rate of the U.S. dollar increases, U.S. goods become more expensive to foreigners. Net exports fall and aggregate demand shifts to the left.

V. The Aggregate-Supply Curve

A. The relationship between the price level and the quantity of goods and services supplied depends on the time horizon being examined.

B. Why the Aggregate-Supply Curve Is Vertical in the Long Run

1. In the long run, an economy’s production of goods and services depends on its supplies of resources along with the available production technology.

2. Because the price level does not affect these determinants of output in the long run, the long-run aggregate-supply curve is vertical.

3. The vertical long-run aggregate-supply curve is a graphical representation of the classical theory.

C. Why the Long-Run Aggregate-Supply Curve Might Shift

1. The position of the aggregate-supply curve occurs at an output level sometimes referred to as potential output or full-employment output.

2. Definition of natural rate of output: the production of goods and services that an economy achieves in the long run when employment is at its natural level.

3. This is the level of output that the economy produces when unemployment is at its natural rate.

4. Any change in the economy that alters the natural rate of output shifts the long-run aggregate-supply curve.

5. Shifts Arising from Changes in Labor

a. Increases in immigration increase the number of workers available. The long-run aggregate-supply curve would shift to the right.

b. Any change in the natural rate of unemployment will alter long-run aggregate supply as well.

6. Shifts Arising from Changes in Capital

a. An increase in the economy’s capital stock raises productivity and thus shifts long-run aggregate supply to the right.

b. This would also be true if the increase occurred in human capital rather than physical capital.

7. Shifts Arising from Changes in Natural Resources

a. A discovery of a new mineral deposit increases long-run aggregate supply.

b. A change in weather patterns that makes farming more difficult shifts long-run aggregate supply to the left.

c. A change in the availability of imported resources (such as oil) can also affect long-run aggregate supply.

8. Shifts Arising from Changes in Technological Knowledge

a. The invention of the computer has allowed us to produce more goods and services from any given level of resources. As a result, it has shifted the long-run aggregate-supply curve to the right.

b. Opening up international trade has similar effects to inventing new production processes. Therefore, it also shifts the long-run aggregate-supply curve to the right.

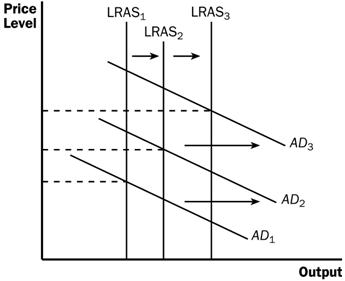

D. Using Aggregate Demand and Aggregate Supply to Depict Long-Run Growth and Inflation

1. Two important forces that govern the economy in the long run are technological progress and monetary policy.

a. Technological progress shifts long-run aggregate supply to the right.

b. The Fed increases the money supply over time, which raises aggregate demand.

2. The result is growth in output and continuing inflation (increases in the price level).

3. Although the purpose of developing the model of aggregate demand and aggregate supply is to describe short-run fluctuations, these short-run fluctuations should be considered deviations from the continuing long-run trends developed here.

E. Why the Aggregate-Supply Curve Slopes Upward in the Short Run

1. The Sticky-Wage Theory

a. Nominal wages are often slow to adjust to changing economic conditions due to long-term contracts between workers and firms along with social norms and notions of fairness that influence wage setting and are slow to change over time.

b. Example: Suppose a firm has agreed in advance to pay workers an hourly wage of $20 based on the expectation that the price level will be 100. If the price level is actually 95, the firm receives 5% less for its output than it expected and its labor costs are fixed at $20 per hour.

c. Production is now less profitable, so the firm hires fewer workers and reduces the quantity of output supplied.

d. Nominal wages are based on expected prices and do not adjust immediately when the actual price level differs from what is expected. This makes the short-run aggregate-supply curve upward sloping.

2. The Sticky-Price Theory

a. The prices of some goods and services are also sometimes slow to respond to changing economic conditions. This is often blamed on menu costs.

b. If the price level falls unexpectedly, and a firm does not change the price of its product quickly, its relative price will rise and this will lead to a loss in sales.

c. Thus, when sales decline, firms will produce a lower quantity of goods and services.

d. Because not all prices adjust instantly to changing conditions, an unexpected fall in the price level leaves some firms with higher-than-desired prices, which depress sales and cause firms to lower the quantity of goods and services supplied.

3. The Misperceptions Theory

a. Changes in the overall price level can temporarily mislead suppliers about what is happening in the markets in which they sell their output.

b. As a result of these misperceptions, suppliers respond to changes in the level of prices and thus, the short-run aggregate-supply curve is upward sloping.

c. Example: The price level falls unexpectedly. Suppliers mistakenly believe that as the price of their product falls, it is a drop in the relative price of their product. Suppliers may then believe that the reward of supplying their product has fallen, and thus they decrease the quantity that they supply. The same misperception may happen if workers see a decline in their nominal wage (caused by a fall in the price level).

d. Thus, a lower price level causes misperceptions about relative prices, and these misperceptions lead suppliers to respond to the lower price level by decreasing the quantity of goods and services supplied.

4. Note that each of these theories suggest that output deviates from its natural rate when the price level deviates from the price level that people expected.

5. Note also that the effects of the change in the price level will be temporary. Eventually people will adjust their price level expectations and output will return to its natural level; thus, the aggregate-supply curve will be vertical in the long run.

6. Because the sticky-wage theory is the simplest of the three theories, it is the one that is emphasized in the text.

F. Summary

1. Economists debate which of these theories is correct and it is possible that each contains an element of truth.

2. All three theories suggest that output deviates in the short run from its long-run level when the actual price level deviates from the expected price level.

![]()

3. Each of the three theories emphasizes a problem that is likely to be temporary.

a. Over time, nominal wages will become unstuck, prices will become unstuck, and misperceptions about relative prices will be corrected.

b. In the long run, it is reasonable to assume that wages and prices are flexible and that people are not confused about relative prices.

G. Why the Short-Run Aggregate-Supply Curve Might Shift

1. Events that shift the long-run aggregate-supply curve will shift the short-run aggregate-supply curve as well.

2. However, expectations of the price level will affect the position of the short-run aggregate-supply curve even though it has no effect on the long-run aggregate-supply curve.

3. A higher expected price level decreases the quantity of goods and services supplied and shifts the short-run aggregate-supply curve to the left. A lower expected price level increases the quantity of goods and services supplied and shifts the short-run aggregate-supply curve to the right.

VI. Two Causes of Economic Fluctuations

A. Long-Run Equilibrium

1. Long-run equilibrium is found where the aggregate-demand curve intersects with the long-run aggregate-supply curve.

2. Output is at its natural rate.

3. Also at this point, perceptions, wages, and prices have all adjusted so that the short-run aggregate-supply curve intersects at this point as well.

B. The Effects of a Shift in Aggregate Demand

1. Example: Pessimism causes household spending and investment to decline.

2. This will cause the aggregate-demand curve to shift to the left.

3. In the short run, both output and the price level fall. This drop in output means that the economy is in a recession.

4. In the long run, the economy will move back to the natural rate of output.

a. People will correct the misperceptions, sticky wages, and sticky prices that cause the aggregate-supply curve to be upward sloping in the short run.

b. The expected price level will fall, shifting the short-run aggregate-supply curve to the right.

5. In the long run, the decrease in aggregate demand can be seen solely by the drop in the equilibrium price level. Thus, the long-run effect of a change in aggregate demand is a nominal change (in the price level) but not a real change (output is the same).

6. Instead of waiting for the economy to adjust on its own, policymakers may want to eliminate the recession by boosting government spending or increasing the money supply. Either way, these policies could shift the aggregate demand curve back to the right.

7. FYI: Monetary Neutrality Revisited

a. According to classical theory, changes in the quantity of money affect nominal variables such as the price level, but not real variables such as output.

b. If the Fed decreases the money supply, aggregate demand shifts to the left. In the short run, output and the price level decline. After expectations, prices, and wages have adjusted, the economy finds itself back on the long-run aggregate-supply curve at the natural rate of output.

c. Thus, changes in the money supply have effects on real output in the short run only.

8. Case Study: Two Big Shifts in Aggregate Demand: The Great Depression and World War II

a. Figure 9 shows real GDP for the United States since 1900.

b. Two time periods of economic fluctuations can be seen dramatically in the picture. These are the early 1930s (the Great Depression) and the early 1940s (World War II).

c. From 1929 to 1933, GDP fell by 27%. From 1939 to 1944, the economy’s production of goods and services almost doubled.

9. Case Study: The Recession of 2001

a. The United States experienced a recession in 2001 where unemployment rose from 3.9% in December 2000 to 6.3% in June 2003.

b. The recession has been attributed to three aggregate demand shocks. First, the dot-com bubble in the stock market ended. Second, the terrorist attack in September 2001 led to increased uncertainty. Third, several corporate accounting scandals were revealed.

c. The federal government passed tax cuts to improve consumer spending, while the Fed responded by keeping interest rates low.

d. By January 2005, the unemployment rate had fallen back to 5.2%.

10. FYI: The Origins of Aggregate Demand and Aggregate Supply

a. The AD/AS model is a by-product of the Great Depression.

b. In 1936, economist John Maynard Keynes published a book that attempted to explain short-run fluctuations.

c. Keynes believed that recessions occur because of inadequate demand for goods and services.

d. Therefore, Keynes advocated policies to increase aggregate demand.

C. The Effects of a Shift in Aggregate Supply

1. Example: Firms experience a sudden increase in their costs of production.

2. This will cause the short-run aggregate-supply curve to shift to the left. (Depending on the event, long-run aggregate supply may also shift. We will assume that it does not.)

3. In the short run, output will fall and the price level will rise. The economy is experiencing stagflation.

4. Definition of stagflation: a period of falling output and rising prices.

5. The result over time may be a wage-price spiral.

6. Eventually, the low level of output will put downward pressure on wages.

a. Producing goods and services becomes more profitable.

b. Short-run aggregate supply shifts to the right until the economy is again producing at the natural rate of output.

7. If policymakers want to end the stagflation, they can shift the aggregate-demand curve. Note that they cannot simultaneously offset the drop in output and the rise in the price level. If they increase aggregate demand, the recession will end, but the price level will be permanently higher.

8. Case Study: Oil and the Economy

a. Crude oil is a key input in the production of many goods and services.

b. When some event (often political) leads to a rise in the price of crude oil, firms must endure higher costs of production and the short-run aggregate-supply curve shifts to the left.

c. In the mid-1970s, OPEC lowered production of oil and the price of crude oil rose substantially. The inflation rate in the United States was pushed to over 10%. Unemployment also grew from 4.9% in 1973 to 8.5% in 1975.

d. This occurred again in the late 1970s. Oil prices rose, output fell, and the rate of inflation increased.

e. In the late 1980s, OPEC began to lose control over the oil market as members began cheating on the agreement. Oil prices fell, which led to a rightward shift of the short-run aggregate-supply curve. This caused both unemployment and inflation to decline.

f. In recent years, the world market for oil has not been as important a source of economic fluctuations.

9. FYI: The Macroeconomic Impact of Hurricane Katrina

a. In August of 2005, the Gulf Coast of the United States was hit by Hurricane Katrina, devastating New Orleans and surrounding areas.

b. The hurricane was expected to reduce aggregate supply by making unavailable some of the productive capacity of the Gulf area.

c. The hurricane was also expected to reduce aggregate demand because gasoline prices rose, causing consumers to decrease consumption of other goods and services.

d. Thus, GDP was expected to decline, but not far enough to move the economy into a recession.