|

AGGREGATE DEMAND

Law of Aggregate Demand

CHANGE IN PL = CHANGE IN NATIONAL OUTPUT (GDP, EMPLOYMENT, NATIONAL

INCOME)

INVERSE

-

FOREIGN PURCHASES EFFECT

-

WEALTH EFFECT

-

INTEREST RATE EFFECT

CHANGE IN NPD= CHANGE IN AD

-

TAXES/SUBSIDIES/

INCOME

-

REAL

WEALTH

-

EXPECTATIONS/FUTURE

Y AND PL

-

DEBT

CHANGE IN AD

=

PL =

PL

AQ AQ

CHANGE IN AD

=

PL =

PL

QL QL

SHORT

RUN AGGREGATE SUPPLY SHORT

RUN AGGREGATE SUPPLY

Law of Aggregate Supply

CHANGE IN PL = CHANGE IN CHANGE IN NATIONAL OUTPUT (GDP, EMPLOYMENT,

NATIONAL INCOME)

DIRECT

CHANGE IN NPD= CHANGE IN AS

-

COST

OF RESOURCE

-

UNEXPECTED

SHOCKS

-

TAXES/SUBSIDIES

CHANGE IN AS

=

PL =

PL

AQ AQ

CHANGE IN AS

=

PL =

PL

AQ AQ

|

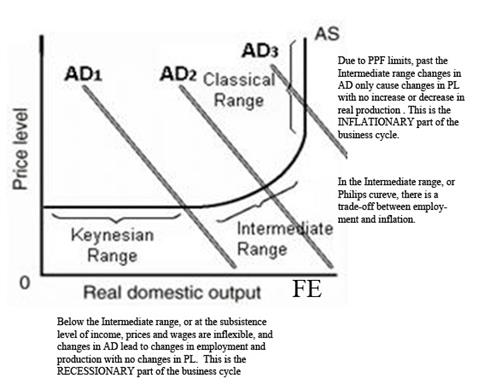

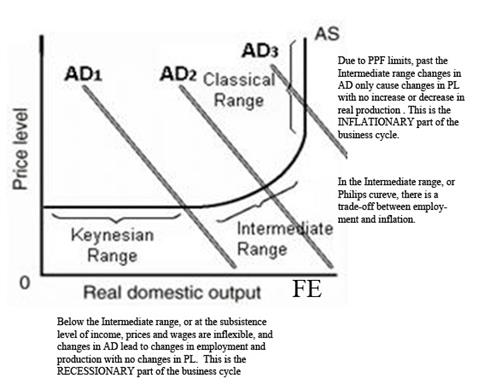

LONG RUN AGGREGATE SUPPLY

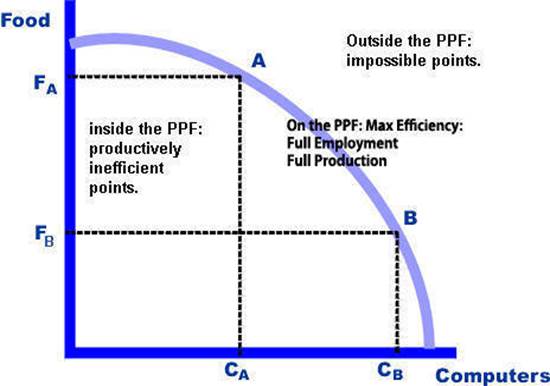

LRAS = PPF

PERFECTLY INELASTIC; UNRELATED TO CHANGES IN PL, LIMITS OF POTENTIAL

PRODUCTION AT FULL EMPLOYMENT

CHANGE IN NPD= CHANGE IN LRAS

-

TRADE

-

INVESTMENT/TECHNOLOGY

-

MORE/LESS RESOURCES

|

CLASSICAL THEORY

-

JOSEPH SCHUMPETER

-

Y = C + S

-

S = I

-

Y = C + I

-

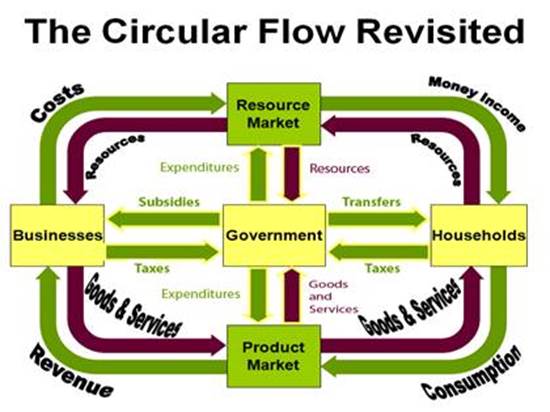

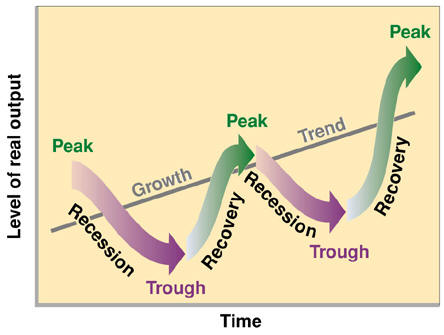

CYCLES ARE TEMPORARY DISEQUILIBRIUMS IN

-

PRODUCT MARKET

-

RESOURCE MARKET

-

MONEY MARKET

-

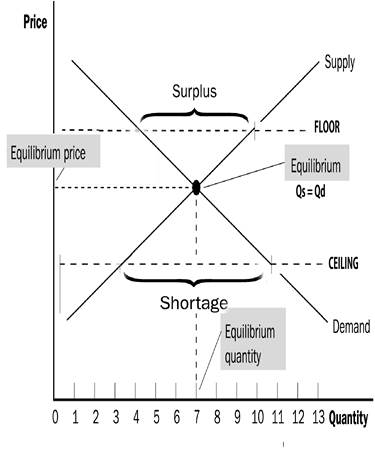

IF AD

THEN S > I

THEN S > I

-

SURPLUS; RECESSION

-

PRICES DROP

-

DEFLATION OR DISINFLATION

-

WAGES DROP

-

INTEREST RATES DROP

-

AS

AND S = I

AND S = I

-

IF AD

THEN S < I

THEN S < I

-

SHORTAGE; INFLATION

-

PRICES RISE

-

WAGES RISE

-

INTEREST RATES RISE

-

AS

AND S = I

AND S = I

|

|

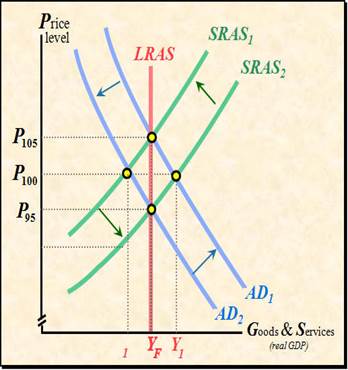

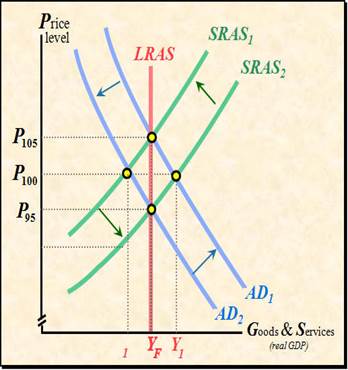

Keyneisan AD/AS and Long Run

Equilibrium

Equilibrium could settle at a level of

economic activity with large amounts of unemployment or Inflation due to

the Ratchet Effect and Cascade failure.

- If potential Real GDP is greater than what actual AD/AS equilibrium, a

recessionary gap exists and may persist indefinitely. The

solution to this unacceptable equilibrium is to increase AD through

FISCAL POLICY.

- If potential Real GDP is less than AD/AS Equlibrium, an

inflationary gap exists and the inflation may

persist indefinitely. The solution to this unacceptable level of

economic activity is to decrease AD with FISCAL POLICY.

|

|

|

MONETARY POLICY/SUPPLY SIDE

-

STRUCTURAL DEBT

-

EXPANSIONARY BIAS

-

CROWDING OUT

-

EXPORT SHOCK\

-

PERMANENT INCOME THEORY

EQUATION OF EXCHANGE

MV = PQ

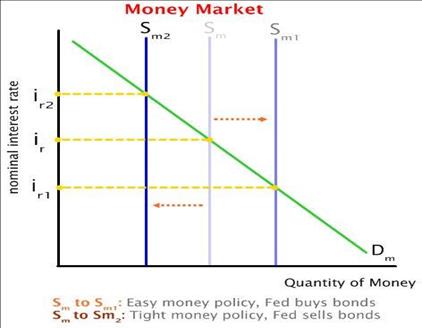

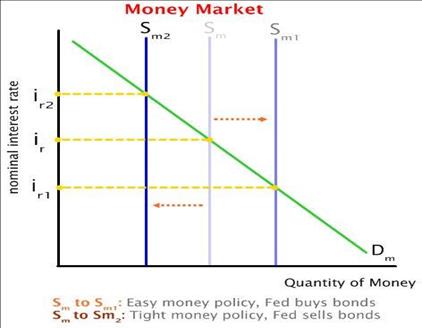

FEDERAL RESERVE MONETARY TOOLS

-

OPEN MARKET

-

DISCOUNT RATE

-

RESERVE RATIO

-

HAMMER

-

CHANGES BOTH M AND V

TIGHT MONEY DECREASES THE MONEY SUPPLY, INCREASES r AND DESCREASES

INVESTMENT, LOWERING AD, GDP, AND EMPLOYMENT

EASY MONEY INCREASES THE MONEY SUPPLY, DECREASES r AND INCREASES

INVESTMENT, INCREASING AD, GDP, AND EMPLOYMENT, AND IN THE LONG RUN

SHIFTING AS TO THE RIGHT.

|

|

|

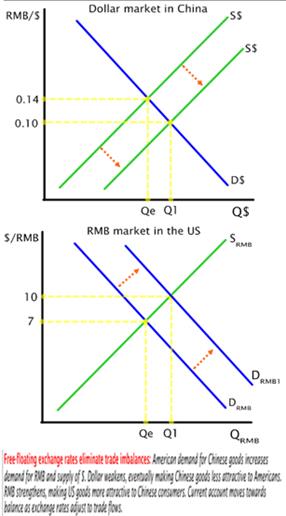

BALANCE OF TRADE: EXPORTS – IMPORTS

BALANCE OF PAYMENTS (CURRENT ACCOUNT): INCOME – EXPENDITURES

FIXED EXCHANGE RATES (PEGGED OR GOLD STANDARD)

REINFORCE/WORSEN CYCLES:

-PEAK CAUSES INCREASED PURCHASES OF FOREIGN GOODS LEADS TO LESS CURRENCY

IN HOME COUNTRY = DEFLATION, RECESSION

-DECREASED PURCHASES OF FOREIGN GOODS LEADS TO INCREASED CURRENCY IN

HOME COUNTRY = INFLATION

COUNTRIES COULD DEVALUE (DECREASE) OR REVALUE (INCREASE) THE THEIR

CURRENCIES WHICH LED TO CURRENCY WARS IN THE 60s AND 70s

|

|

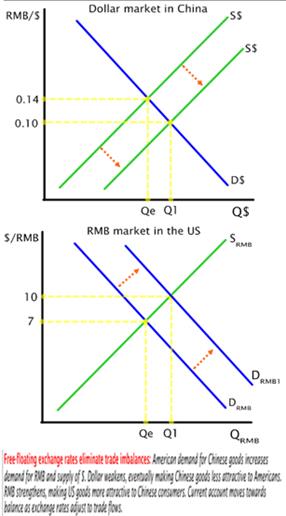

FLOATING EXCHANGE RATES

THE PRIMARY DETERMINANT OF VALUE OF CURRENCY IS COMPARATIVE INTEREST

RATES.

RECESSION:

FISCAL POLICY

DEFICIT (G>TAXES)

-GOVERNMENT BORROWS

-INTEREST RATES INCREASE

-FOREIGNERS WANT HOME CURRENCY TO INVEST, BUY HOME BONDS

BALANCE OF PAYMENTS SURPLUS

-DEMAND FOR HOME CURRENCY INCREASES

-HOME CURRENCY APPRECIATES (MORE VALUABLE); FOREIGN CURRENCY DEPRECIATES

(LESS VALUABLE)

-FOREIGN GOODS CHEAPER: X DECREASE, M INCREASES

BALANCE OF TRADE DEFICIT

MONETARY POLICY

EASY MONEY (BOND PRICES UP, DISCOUNT r DOWN, RR DOWN)

-INTEREST RATES DECREASE

-HOME WANTS FOREIGN CURRENCY FOR INVESTMENT, BONDS

BALANCE OF PAYMENTS DEFICIT

-DEMAND FOR HOME CURRENCY DECREASES

-HOME CURRENCY DEPRECIATES (LESS VALUABLE); FOREIGN CURRENCY APPRECIATES

(MORE VALUABLE)

-FOREIGN GOODS MORE EXPENSIVE: X INCREASES, M DECREASES

BALANCE OF TRADE SURPLUS

|