|

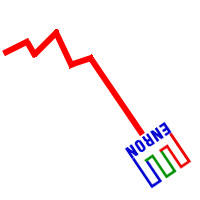

How to Stuff a Wild Enron:

By P.J. O'Rourke

The Atlantic Monthly

|

|

|

|

|

Beyond a certain point complexity is fraud. It's the Airline Ticket Price Axiom. Am I getting the best deal on my airline ticket? How could I know? To map the labyrinth of airline-ticket pricing structure I would have to spend a greater value in time, at the minimum-wage billing rate, than the value of the money I'd save. Or it's the Finnegans Wake Postulate. We all know that Joyce, the old soak, was just scribbling a learned version of what Jack Nicholson typed in The Shining. Maybe "complexity is fraud" doesn't apply to mathematics or the physical sciences. Nevertheless, when someone creates a system in which you can't tell whether or not you're being fooled, you're being fooled. This is true in the intellectual food chain from the fine arts, literature, and sociology on down. And Enron was pretty far downódown there among the cunning weasels of ratiocination. What Enron was doing, what caused investors to embrace it in a rapture of baffled awe, was hiding debt. Several friends of mine who work in finance tried to give me a simplified model of the kind of thing Enron would do: Enron would have some business in which it had invested a lot of money. But that business wasn't making a profit. Enron would form a partnership with outside investors. The partnership would buy the business. But almost all the money to buy the business would be lent to the partnership by Enron, usually in the form of stock. Enron would count the sale of that business as income and count the loan to the partnership as an asset. The unprofitable business would disappear from Enron's financial statement, because under accounting conventions, if a mere three percent of capital is brought into a partnership from outside a corporation, then the corporation doesn't have to carry that partnership on its books. Enron's liabilities were turned into black ink. Enron engendered these partnerships with wild fecundity and in many variations; but some of the most important of them, to stay vital, depended on a high market price for Enron stock. Meanwhile, Arthur Andersen auditors were standing by reciting the only joke that makes accountants laugh: "Q. What's two minus two? A. Whatever the client wants it to be." I've got to hurry and hire Arthur Andersen before everyone in the firm gets sent up the river to Club Fed. I'm going to tell my new accountants, "I had this expensive divorce. But I figure you can list it as an asset. Because, believe me, no matter what that divorce cost, it was worth it." Enron was, by the common if not by the legal definition, defrauding the people who bought its stock. Is there something in the American capitalist system that encourages such fraud? Yes: the regulations against it. Generally accepted accounting principles consist of 144 standards, each requiring a volume of explication. Title 17 of the Code of Federal Regulations, covering commodity and securities exchanges, is 2,330 pages long. Federal tax law runs to 3,778 pages, with an additional 12,888 pages of IRS tax code regulations. There are plenty of places to hide in this vast briar patch of dos and don'ts. Enron broke the rules of ethics. But the corporation's worst sins seem to have been lawful: the Gordian partnership ties, the tales of profit and growth enhanced for dramatic effect, the taxes avoided by sending revenues on vacation to the Cayman Islands, the freezing of employee 401(k)s in the ice-cube tray of the company's own stock, the auditing firm with about half its Enron fees gained from provision of other accounting services, so that Arthur Andersen accountants were cooking the very books that Arthur Andersen auditors were expected to swallow. And so on. According to The Economist, even Kenneth Lay's eleventh-hour stock sales may not have violated SEC regulations, because Lay was selling the stock to repay personal loans from the corporation; hence insider-trading restrictions did not (for reasons known only to someone who reads and marks with Hi-Liter pens all 2,330 pages of Title 17) apply. Enron was supposed to be a supporter of marketplace deregulation. In a January 21 Newsweek article, "Who Killed Enron?," Allan Sloan wrote,

But Jerry Taylor, the director of natural-resource studies at the Cato Institute (which really favors deregulation), points out that Enron lobbied for strict price controls on rates charged for access to power grids. Except when Enron lobbied otherwise, in places such as Texas and Louisiana, where Enron had bought those power grids. Then legislators were urged to let grid owners do what they liked. Bill Keller, the author of a January 26 New York Times column titled "Enron for Dummies," wrote, "Enron believed in reducing regulation of Enron." And so believes every other

regulated industry. This is why regulated industries set out to

"capture" their regulatory bodies. Usually the tranquilizer guns and

large nets work well. On the front page of the January 28 Wall Street

Journal a headline read "FEDERAL REGULATOR OFTEN HELPS BANKS

FIGHTING CONSUMERS." The Cato Institute's president, Ed Crane, calls generally accepted accounting principles "skewed in favor of management, not investors." Of course they are. Enron's management paid Arthur Andersen $25 million in auditing fees in 2000. I paid H&R Block $80. The SEC allows an astonishing conflict of interest in large financial-services firms that can make fortunes doing investment banking for corporations and then make more fortunes advising me to buy stock in those corporations and taking a commission when I do. The so-called Chinese wall between the two sides of the business is as effective as the one that Genghis Khan walked through the gates of in the thirteenth century. Enron stock reached a high of $90.75 in August of 2000. According to The Wall Street Journal, only one Wall Street analyst put a "sell" recommendation on it before the price fell below $10. And this despite a damning article in the March 5, 2001, Fortune (when Enron stock was trading at $70) by Bethany McLean, who called Enron's business activities "impenetrable to outsiders" and "mind-numbingly complex" and said, "As for the details about how it makes money, Enron says that's proprietary information, sort of like Coca-Cola's secret formula." Regulation creates a moral hazard. We don't understand finance, but it's regulated, so we're safe. "Regulation," Jerry Taylor says, "dulls the senses that you would take into an unregulated situation. If you hear screaming in the middle of the night, you assume it's hot sex, not murder." Regulation of the marketplace isn't bad. The problem is, rather, that the regulation we have now is too goodóat least in its intent. Our regulatory bodies strive to create honest dealings, fair trades, and a situation in which no one has an advantage over anyone else. But human beings aren't honest. And all trades are made because one person thinks he's getting the better of the other, and the other person thinks the same. And you will always have an uncle who's heard about a merger on the golf course, whereas I've got an uncle who gets his inside information at the OTB parlor. Regulation would be better if its goal were not to ensure probity in finance but to rake muck. Get all the dirty laundry out in public: the ripped bodice of the hostile take-over, the stock jobber's filth-splattered britches, the soiled undershirt of dodgy bookkeeping, and campaign funding's reeking, horrible socks. |