|

The Rematch:

By Saul Hansell 14 November 2004 |

|

|

|

|

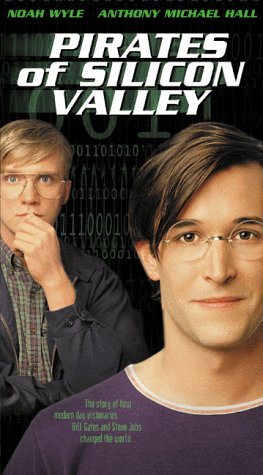

The history of Apple Computer can be told through its advertisements as well as its products. There was, of course, the commercial that introduced the Macintosh. It was broadcast exactly once, during the 1984 Super Bowl, and signaled the company's bid to reclaim leadership in personal computers from IBM and its tiny, little-known software partner, Microsoft. Late last month, Steve Jobs, Apple's chairman, rented an ornate theater here to promote Apple's latest advertisement for its iPod music player --a crisp psychedelic montage of the Irish pop band U2 playing "Vertigo," a song from its next album. Unlike the 1984 commercial, this one is intended to help Apple preserve a big, and growing, lead in the marketplace. Speaking just after the event, Bono, U2's lead singer, said the band was not charging Apple a penny to be in the ad. (The band says it had turned down as much as $23 million to use its music in other commercials.) In its three-year life, the iPod has achieved such "iconic value," Bono said, that U2 gets as much value as Apple does from the commercial, by promoting its music and the new Red and Black U2 edition of the iPod, for which the band gets royalties. The iPod, Jobs boasted at the event, has become the "Walkman of the 21st century." It dominates its market in a way that no Apple product has done in a generation, raising the possibility that the company is becoming more than just a purveyor of computers with high design and low market share. If Apple continues to ride the wave of digital consumer electronics products, it may become the Sony of the 21st century. For that to happen, however, Jobs must do what he failed to do last time: prevail over his old nemesis, Bill Gates, who sees entertainment as Microsoft's next great frontier. Microsoft is working hard to make sure that the iPod is less like the Walkman and more like the Betamax, Sony's videocassette format that was defeated in the marketplace by VHS. A few days after Apple's U2 extravaganza, Gates, Microsoft's chairman, paced around his office overlooking the rolling hills of suburban Seattle and recalled another advertisement that Apple made 25 years ago. "When IBM came out with their PC, Apple ran an ad saying, "Welcome,'" Gates said. "Apple hasn't yet run the ad welcoming us into the music business. "They should," he added. But he isn't holding his breath. Instead, Microsoft is turning up the volume in the portable music business. And Gates makes no secret that he expects to beat Jobs in that market as convincingly as he did in personal computers. A Familiar Tune In music, Microsoft has rallied nearly every other manufacturer--like Dell, Samsung and Rio--to support a new version of Windows Media. That audio standard allows their gadgets to play songs bought from most music service companies, including America Online, Napster and RealNetworks, as well as its own new MSN Music store. Microsoft's campaign slogan for the services and players is "plays for sure." The iPod cannot play songs from most other stores, and Apple's iTunes store won't sell songs for other players. Gates argues that consumers ultimately will want more choices. "There's nothing unique about music in terms of, do people want variety of fashion, do people want low price, do they want many distribution channels?" he said. "This story has played out on the PC and worked very well for the choice approach there." Jobs rejects the comparison between the music players and computers. The Macintosh had an uphill battle, Apple says, because so many corporate customers already had applications based on Microsoft's operating system that they didn't want to abandon. By contrast, Apple's iTunes Music Store sells pretty much the same songs that the others do, but they cannot be moved onto non-Apple portable devices. Most important, he points out, Apple's market share has actually increased during the past year, despite increasing competition. "We offer customers choice," he said during a news conference after the U2 event, answering a question about Microsoft's strategy. "They don't like the choices our customers are making." Indeed, in the third quarter, some 2 million iPods were sold--more than all of its competitors combined, and more than double the pace of the second quarter. Market analysts and even rivals expect that Apple will sell more of them this holiday shopping season and continue to dominate the market into next year. What happens next holiday season and beyond, however, is a matter of considerable debate. Microsoft fans say that other music players will begin to match Apple's features and styling, and with lower prices. They suggest that consumers, meanwhile, will want to buy music from stores other than iTunes. "Over time, proprietary standards always lose because industry standards always win because you get more for less," said Michael A. George, the general manager of Dell's consumer business. Dell has just introduced a 5GB music player, using the Windows standard, for $199, some $50 less than Apple's iPod Mini, which has 4 gigabytes. Microsoft is also betting that a new crop of subscription services, like Napster to Go, which let users fill up a music player with thousands of songs for a flat fee of $10 to $20 a month, will prove attractive to consumers. Jobs, by contrast, spent months convincing the record labels to allow Apple to sell songs one at a time for 99 cents each, and he argues that consumers prefer owning music to renting it. "If you sit down next to me and say you have 1,000 songs and you pay $10 a month, how cool will I feel to say I paid $1,000 for 1,000 songs," asked Jonathan Sasse, the president of iRiver America, a subsidiary of ReignCom, a Korean maker of portable players that has endorsed Microsoft's format for subscription services. Rocking the Industry Again, Apple is bucking the trend. The classic Silicon Valley playbook calls for the company to try to turn its hit product into a broader "platform." And many people argue that Apple should open up both the iPod and iTunes to rivals, so as to establish itself in the center of the digital music world. But Geoff Moore, who articulated the platform strategy in his 1999 book "Crossing the Chasm," argues that Apple is the rare company that should not follow his advice. Jobs, he said, has built the company around idiosyncratic, premium-priced products that gain appeal in part from their splendid isolation. It's a risky strategy, Moore contends. "You are only as good as your latest hit," he said. "You know at some point you will miss a step." But he says Apple is better off rolling the dice than trying to try to emulate Microsoft. "It is hard to change the DNA of a company, even if you have a great hand," he said. "There are some times that you say, 'there is a great opportunity here, but it is not for us.'" There is no question that Apple has played the music business like a virtuoso, after ignoring the first several years of the online music boom. When Apple became interested in music players in 2001, it rejected the most common technology in the market, flash memory chips, which can make inexpensive players that can hold a few dozen songs. Rather, it latched onto an emerging design based on a hard drive that could hold thousands of songs. A few hard-drive players already existed, but they were bulky. For the iPod's introduction, Apple bought the entire inventory of a new generation of smaller drives from Toshiba, making the iPod the sleekest hard-drive player in the market. This prevented rivals from offering the smaller players for months. Since then, Apple has been quick to add new features. In the spring, it introduced the iPod Mini, based on 1-inch drives, and last month it introduced iPod Photo, with the ability to bore your friends with thousands of snapshots of your latest vacation on its small color screen. Each innovation was matched quickly by rivals, but Apple was able to cement its position in the minds of its consumers as the leader in online music. Out of Tune The pioneers in the market were Rio (born as Diamond Multimedia) and Creative Technology, both makers of add-on sound cards for PCs. Neither had Apple's marketing savvy or budget. Samsung, for its part, chose to focus on the more lucrative cellphone and flat-panel television businesses, letting its MP3 business flounder. Indeed, Apple has been able to keep its leading share even though its products are priced above similar models from rivals. Judging by its latest crop of products, Apple seems to believe that its profit margins can grow. The U2 iPod, for example, is priced at $349, or $50 more than an identical model with a white case. Adding the photo features to an iPod costs less than $20, competitors say, but Apple has been able to charge $100 extra for iPod Photo, over the $399 price of the comparable, music-only player. "The iPod is an affordable luxury," said Michael Gartenberg, the research director of Jupiter Research. "It's not the cheapest player on the market, but you don't spend thousands of dollars extra to own one." While Apple has not opened the iPod to other music stores, it did make an important decision to go after the broader market by building a version for Windows computers. And it reached an agreement with Hewlett-Packard for HP to resell iPods and install iTunes software on its computers. Microsoft has been developing the Windows Audio formats for nearly a decade as part of the media player built into Windows. It has long licensed these formats for use in portable players, and it recently added features for so-called digital rights management, which allow music labels to control who plays a song and under what circumstances. (Apple developed its own digital rights plan, called FairPlay, that also is intended to thwart digital piracy.) As the underdog in audio technology, Microsoft has marshaled its formidable resources to get others behind its standard. For example, the fee that electronics companies pay to license the Windows Media format is about half of what the owners of MP3 charge. And Microsoft has offered all sorts of engineering help and marketing muscle to electronics companies and music service purveyors in return for their adopting the Windows formats. "Microsoft made it worth our while to get them into our box," said Hugh Cooney, the president of Rio, a unit of D&M Holdings of Japan. Rio had been using software from RealNetworks. "They bring a whole suite of service to us, marketing, help with testing and engineering support," he said. Not surprisingly, RealNetworks was not thrilled. Last year, it filed a $1 billion antitrust suit against Microsoft, accusing it of anticompetitive practices in the player software market. In the meantime, RealNetworks has largely abandoned that business to focus on selling subscription music and video services. Microsoft also raised hackles recently when it started its MSN Music Store to compete with companies like Napster that it had been courting for years. That isn't so unusual for Microsoft, its executives say. The company often finds itself both competing and cooperating, they say, with companies in the software business. For the most part, though, the music world, from the electronics companies to the music labels, has embraced Microsoft. "I never would have believed I would say this, but Microsoft has been easy to work with," said Ted Cohen, a senior vice president at EMI Recorded Music. One reason that Microsoft can be so accommodating is that it does not need to make money on media software, as RealNetworks does. It does sell operating systems for telephones, personal digital assistants and television set-top boxes. But all of these are meant first and foremost to encourage people to buy more and more powerful PCs, each with Windows.

"The key to all this is that in the end, the consumer gets a great experience with digital entertainment that the PC makes better," said Will Poole, the senior vice president of Microsoft's Windows client division. Many other PC makers, like HP, Dell and Gateway, see their futures in consumer electronics and have started making devices like cameras, flat-screen televisions and music players. They also hope to sell more computers, based on Microsoft's Media Center software, to power home entertainment systems. Apple's leading position with the iPod, marketing experts say, could give it a leg up in these other markets. That is why some analysts are puzzled that Apple's sleek new iMac, a computer built into a flat-panel display, does not record and play television shows the way a Media Center PC does. Jobs declines to discuss his product plans. He has been openly contemptuous of attempts to add video playback to hard-drive music players, as Microsoft has with its new design called Portable Media Center. And other Apple executives pointed out that the Media Center PC had not been a success in the market until recently, and that Apple tried to sell computers with TV tuners in them a few years ago, with disappointing results. Longtime Apple watchers say they recognize a pattern. In the past, they say, Jobs has often dismissed a market as irrelevant before introducing just such a product, with a great flourish. He then explains that he has solved the problems his lesser competitors couldn't. It worked stunningly well with music. And many expect that he will try again, with some products related to television. Microsoft, however, cares far less about music than it does about television, a much bigger market. It has attacked it from many sides--not only with the Media Center PC and Portable Media Center, but with software for cable boxes, WebTV and the Xbox video game system. None of these have left Microsoft with a position in television that is even slightly similar to its chokehold on computers. (And it's not clear that Hollywood and the cable companies would like that to happen.) But the company has patience that is almost as deep as its pocketbooks. So it is easy to imagine, a few years from now, that an elegant, hip Apple digital television product will be battling for the home entertainment market against a much larger army of rivals using various forms of Microsoft software. "It's a classic one," Gates said. "Apple has always been a hardware company. I think Apple will do things the Apple way, and Microsoft will do things the Microsoft way. I'd say the long-term factors all favor our approach." © 2004 The New York Times. All rights reserved. No part of this article may be reproduced or copied by any means without written permission.

|