AP Economics

Mr. Crawford

MicroEconomics Exam Review Guide

CONSUMER CHOICE and ELASTICITY

MARGINAL UTILITY

- LAW OF DIMINISHING MARGINAL UTILITY

- IRRATIONAL GOODS

-

MU of product A/price of A = MU of product B/price of B = etc.

ELASTICITY

- DETERMINANTS OF ELASTICITY

- TIME

- SUBSTITUTES

- NECESSITY

- INCOME

- TOTAL REVENUE TEST

- P

= TR

= TR

- E<1, INELASTIC

- P

= TR

= TR

- E>1, ELASTIC

- P

-

"Good Enough Formula":

- DEMAND CURVES

- MORE ELASTIC AT HIGH PRICES

- MORE INELASTIC AT LOW PRICES

- UNIT ELASTIC AT EQUILIBRIUM

|

E = |

|

(Q2 - Q1/Q1) |

|

|

|||

|

(P2 - P1/P1) |

COSTS

COSTS

- EXTERNAL

- INTERNAL

- EXPLICIT

- FIXED

- RENT

- INTEREST

- VARIABLE

- WAGES

- FIXED

- IMPLICIT

- NORMAL PROFIT

- (OPPORTUNITY COST)

- EXPLICIT

- TOTAL REVENUE = P X Q

- TOTAL REVENUE - INTERNAL EXPLICIT COSTS = ACCOUNTING PROFIT

- ACCOUNTING PROFIT - NORMAL PROFIT = ECONOMIC PROFIT

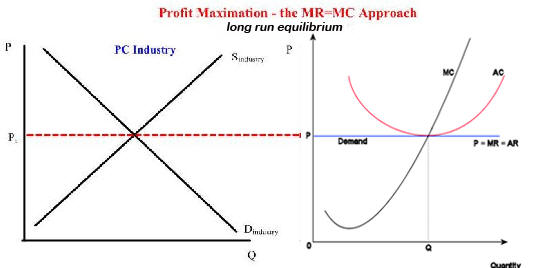

- PRODUCTIVE EFFICIENCY

- P = ATC

- EP = 0

- FAIR RETURN

- ALLOCATIVE EFFICIENCY

- P = MC

- NATURAL EQUILIBRIUM

- SOCIALLY OPTIMAL

- X EFFICIENCY

- MINIMUM POSSIBLE LONG RUN ATC

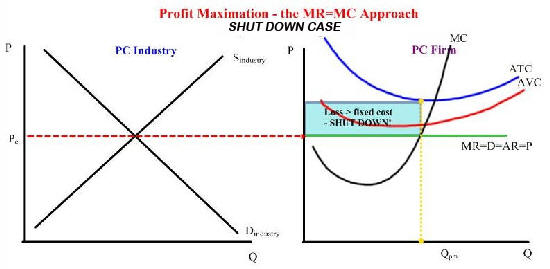

PROFIT MAXIMIZATION FORMULA

- if TR

>

TC

- then MAX PROFIT

- PRODUCE AT MR > MC

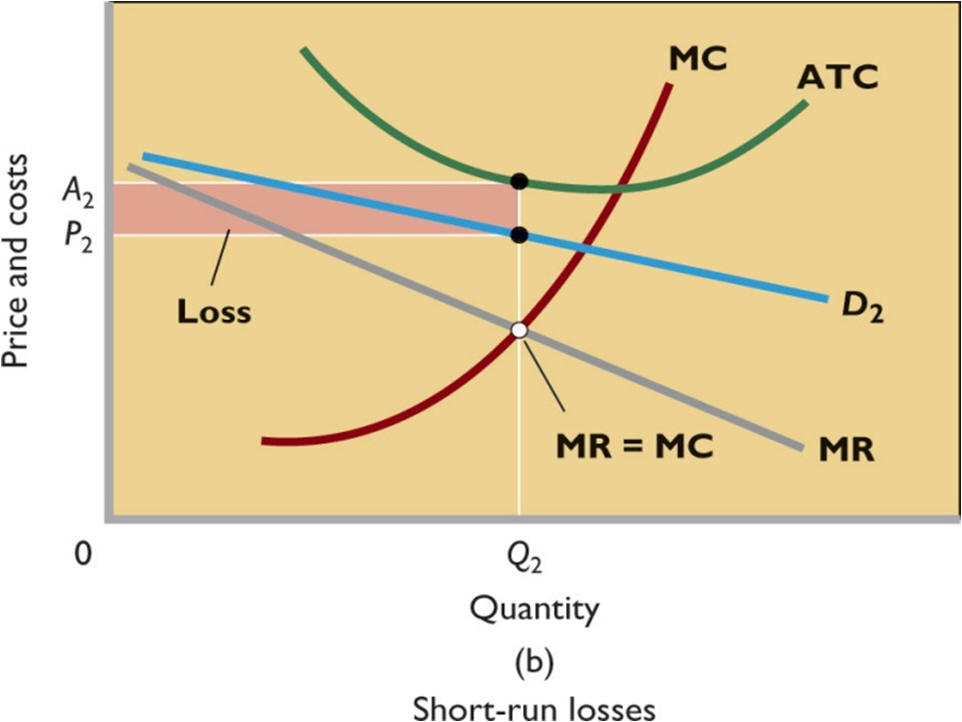

if TR < TC

- but TR > TVC

- then MIN LOSSES

- PRODUCE AT MR > MC

- LOSE LESS THAN TFC, BUT LONG RUN LOOK TO SHUT DOWN

if TR < TVC- then SHUT DOWN

- LOSE TFC

MARKET MODELS

|

PERFECT COMPETITION

|

MONOPOLISTIC COMPETITION

|

OLIGOPOLY

|

MONOPOLY

|

|

PRICE TAKER RISK TAKER |

PRICE MAKER RISK TAKER |

PRICE MAKER RISK AVOIDER |

PRICE MAKER- DEMAND IS VERY CLOSE TO PERFECTLY INELASTIC RISK AVOIDER |

|

|

|

|

COSTS

- EXTERNAL

- INTERNAL

- EXPLICIT

- FIXED

- RENT

- INTEREST

- VARIABLE

- WAGES

- FIXED

- IMPLICIT

- NORMAL PROFIT

- (OPPORTUNITY COST)

- EXPLICIT

- TOTAL REVENUE = P X Q

- TOTAL REVENUE - INTERNAL EXPLICIT COSTS = ACCOUNTING PROFIT

- ACCOUNTING PROFIT - NORMAL PROFIT = ECONOMIC PROFIT

- PROFIT MAXIMIZATION FORMULA

- TR

>

TC

- MAX PROFIT

- PRODUCE AT MR > MC

- TR < TC

- TR

>

TVC

- MIN LOSSES

- PRODUCE AT MR > MC

- LOSE LESS THAN TFC, BUT LONG RUN LOOK TO SHUT DOWN

- TR < TVC

- SHUT DOWN

- LOSE TFC

- TR

>

TVC

- ALL MARKETS IN LONG

RUN EQUILIBRIUM

- EP = 0

- PRODUCTIVE EFFICIENCY

- P = ATC

- EP = 0

- FAIR RETURN

- ALLOCATIVE EFFICIENCY

- P = MC

- NATURAL EQUILIBRIUM

- SOCIALLY OPTIMAL

- X EFFICIENTY

- MINIMUM POSSIBLE LONG RUN ATC

- MANY FIRMS

- EASY ENTRY INTO MARKET

- DIFFERENTIATED PRODUCT

PRICE MAKER

RISK TAKER

CHOOSE NOT TO PRICE DISCRIMINATE, SO P DOES NOT EQUAL MR

PROFIT MAXIMIZATION FORMULA IN IMPERFECT COMPETITION:

- TR

>

TC

- MAX PROFIT

- PRODUCE AT MR > MC

- BUT Qs

<

Qd

- SHORTAGE

- SO P

= Qd

= Qd

- UNTIL Qd = Qs

- ARTIFICIAL EQUILIBRIUM

FOR MONOPOLISITIC COMPETITION

- LONG RUN

- IF EP > 0

- FIRMS ENTER

- ATC

- P

- EP = 0

- IF EP < 0

- FIRMS LEAVE

- ATC

- P

- EP = 0

- IF EP > 0

- LONG RUN PRODUCTIVE EFFICIENCY

- X-EFFICIENCY

- OVERCAPITALIZATION FOR POTENTIAL EXPANSION

- NOT ALLOCATIVE EFFICIENT

- A FEW FIRMS

- DIFFICULT ENTRY INTO MARKET

- DIFFERENTIATED PRODUCT

- INTERDEPENDENT

- NASH BOX

- PRISONER'S DILEMMA

PRICE MAKER

RISK AVOIDER

- KINKED DEMAND CURVE

- IF P

- OTHER FIRMS KEEP PRICE THE SAME

- SO DUE TO SUBSTITUTION EFFECT, Qd

- IF P

- TR

- E > 0

- IF P

- OTHER FIRMS LOWER PRICES

- PRICE WAR

- Qd CONSTANT

- TR

- E < 0

STABLE MARKET

COLLUSION IF THREATENED FROM OUTSIDE

- X-EFFICIENCY

- OVERCAPITALIZATION FOR POTENTIAL EXPANSION

- NOT PRODUCTIVE EFFICIENCY

- NOT ALLOCATIVE EFFICIENT

- ONE FIRM

- IMPOSSIBLE ENTRY INTO MARKET

- STANDARD PRODUCT

PRICE MAKER

RISK AVOIDER

- CONTESTABLE MARKET

- IF NOT X-EFFICIENT, FIRMS WILL TAKE ADVANTAGE OF WINDOW OF OPPORTUNITY

- INNOVATION COMES FROM OUTSIDE

- HIT AND RUN COMPETITION

- NON PRODUCTIVE COSTS

- PREDATORY PRICING

- PRICE DISCRIMINATION

- TYING CONTRACTS/BUNDLING

- LOBBYING, LAWSUITS, LYNCHING

- GOVERNMENT REGULATION

- BREAK UP

- NATURAL MONOPOLY

- LONG RUN COSTS ARE SUCH THAT OPTIMAL EFFICIENCY IS ACHIEVED WITH ONLY ONE FIRM PRODUCING

- ECONOMIES OF SCALE

- PRICE REGULATION

- SOCIALLY OPTIMAL PRICE

- OVERCAPITALIZATION

- FAIR RETURN PRICE

- X-INEFFICIENCY

- OVERCAPITALIZATION

- PROTECT AGAINST POTENTIAL COMPETITORS

- DEFEND AGAINST GOVERNMENT PRICE REGULATION

- OVERCAPITALIZATION

- NOT PRODUCTIVE EFFICIENCY

- NOT ALLOCATIVE EFFICIENT

RESOURCE MARKETS

RESOURCE MARKET

PERFECT COMPETITION

HOUSEHOLDS ARE SELLERS OF RESOURCES

-

LAND = A

-

CAPITAL = K

-

LABOR = L

BUSINESSES ARE BUYERS OF RESOURCES

- MRP = MR

- MRC (MFC) = MC

LEAST COST FORMULA FOR A COMBINATION OF RESOURCES:

| MRPL | = | MRPA | = | MFCK | = 1 |

| MFCL | MFCA | MFCK |

PROFIT MAXIMIZATION FORMULA

MRP > MFC

RESOURCE MARKET

IMPERFECT COMPETITION

MONOPSONY

PROFIT MAXIMIZATION FORMULA

-

TR > TC

- MAX PROFIT

- PRODUCE AT MRP > MFC

-

BUT Qs > Qd

- SURPLUS

- UNEMPLOYMENT

-

SO W

=

Qd

=

Qd

- UNTIL Qd = Qs

- ARTIFICIAL EQUILIBRIUM